Many Americans prefer moving to Portugal from the US because of the social and political unrest. Portugal stands out as a top destination, offering a high quality of life in a stable European setting. According to the latest official data in 2023, over 14,000 Americans live in Portugal. Proving that recent studies show that over 60,000 expats have decided to live in Portugal, with 11 percent of them being US citizens.

Although Americans can stay in Portugal for up to 90 days without a visa, they need a residency permit to move to Portugal for the long term. Therefore, if your main aim is to live there full-time, you need to apply for a residency visa at the Portuguese Embassy or Consulate in the US. In this guide for Americans, we will give you advice about everything you need to know before immigrating to Portugal from the USA. So, don’t rush into discussion forms, as it will only leave you more hesitant than before. Read our guide for true guidance before you move to Portugal.

Key Takeaways for Americans Moving to Portugal

- As an American, you don’t need a visa to enter Portugal for stays up to 90 days in 180 days for tourism or business purposes. If you are planning to stay longer, you must apply for a residence permit type that suits you by gathering the necessary documents.

- The most common Portugal visas for US citizens are D2 for entrepreneurs, D7 for retirees, D8 for digital nomads, and the Portugal Golden Visa for investors.

- During your residency visa application, you will typically include a valid passport, proof of income, health insurance, and a clean criminal record certificate.

- The application process usually takes about 3-12 months, depending on the visa type.

- You can include your spouse and dependents in your residence application.

- Most residence permits are initially valid for 1–2 years and can be renewed. (Golden Visa is valid for 5 years)

- After living in Portugal for 5 years, you may apply for permanent residence or citizenship. For citizenship applications, you need to meet language and good conduct requirements.

- US immigrants to Portugal can also obtain Portuguese citizenship through descent, marriage, and naturalization if they meet the legal requirements.

- Portugal and the US have a double taxation treaty, meaning that you may be exempt from taxes on your foreign income.

- You can continue receiving US Social Security benefits while living in Portugal.

- The cost of moving to Portugal can range from $9,000 - $13,000, depending on your needs.

- Life in Portugal can bring you many benefits in terms of education, healthcare, work-life balance, low cost of living compared to the US, and tax exclusions.

What to Discover in This Guide?

- Why Americans Are Moving Abroad: Top 9 Reasons

- How To Move to Portugal From the USA

- Top 5 Portugal Visa Types for US Citizens

- Moving to Portugal From the USA

- Cost of Living Portugal vs. the US

- 6 Steps to Get a Mortgage in Portugal

- Opening a Bank Account in Portugal as a US Citizen

- Taxes for American Expats in Portugal

- Pros and Cons of Living in Portugal as an Expat

- Where to Live in Portugal as an American: 6 Best Cities

Why Americans Are Moving Abroad: Top 9 Reasons

We explore this topic in one of our recent reports, “The Great American Exodus Re-visit,” examining the rise in Americans seeking a second residence or citizenship.

According to the report, below are the reasons why Americans are moving abroad:

- Retirement Planning: Many retirees seek destinations with lower living costs and a more secure, pension-friendly lifestyle.

- High Living Expenses: The rising cost of housing, healthcare, and everyday necessities leads people to move to more affordable countries.

- Social and Political Unrest: Increasing polarization, instability, and frustration with domestic issues are key factors.

- Healthcare Costs: The high cost of healthcare in the US drives people toward countries with universal or more affordable medical care.

- Dissatisfaction with the US Work Culture: Many professionals are moving away from the “hustle culture” in search of a healthier work and life balance.

- Work-Life Balance & Digital Nomadism: Remote workers, freelancers, and entrepreneurs often choose countries that support flexible lifestyles and better quality of life.

- Buying a Vacation Home: Some Americans invest in real estate abroad to secure residency while enjoying a second home.

- Investment Purposes: Funds and crypto investors are increasingly looking to diversify their portfolios internationally.

- Tax Benefits: Tax-friendly jurisdictions appeal to those seeking to optimize their financial planning.

Furthermore, over 1,300 Americans formally renounced their citizenship in the first half of 2024, up from more than 30,000 in the last decade. This trend reflects Americans’ intent for financial security and improved quality of life in the face of economic uncertainty and social change.

How To Move to Portugal From the USA

Technically, Americans don’t need to get a visa to enter Portugal. Anyone with an American passport can enter the country for up to 90 days for tourist or business purposes. Nevertheless, if your plan is moving to Portugal from the USA, then you’ll need to get an appropriate residence permit.

The Portuguese government offers different kinds of visas, such as a residence visa, a work visa, and a family reunification visa.

As an American, you need to get a Portuguese residence permit if you’re planning to stay there for longer than three months. If you reside in Portugal with a proper residence permit for five years, you can then apply for permanent residency or Portuguese citizenship.

Top 5 Portugal Visa Types for US Citizens

As it is stated earlier, if you plan to stay more than 90 days in Portugal, you must obtain a residence visa:

1. Portugal Golden Visa

Launched in 2012, the Portugal Investor Visa program allows applicants to invest in the country and obtain Portuguese resident cards. Although there is no longer a real estate option since 2023 via the “Mais Habitação Law”, you can still make a qualifying investment for available options. Thus, you can get a five-year residence permit with minimum stay requirements and family inclusion opportunities.

Besides, as a Portugal Golden Visa cardholder, you will get the chance to reside, work, and study in Portugal and travel freely across the Schengen Area.

To be eligible for the Portugal Golden Visa program, you must make a qualifying investment for the options stated below:

- Investment Funds: €500,000

- Business and Job Creation: No fixed amount (create at least 10 full-time jobs for Portuguese nationals)

- Scientific or Technological Research: €500,000

- Cultural or Heritage Preservation: €250,000

- Capital Transfer: €1.5 million

The applicants who complete the process can apply for Portuguese citizenship five years after the initial application date to AIMA.*

*The timeline for citizenship may be subject to change. For more details, please read our detailed article here.

2. Portugal’s D7 Visa

The D7 Visa in Portugal is also commonly referred to as the retirement visa. It’s a residence visa for retirees and passive income holders, who wish to move to Portugal. Portugal Retirement Visa is very popular among Americans retiring in Portugal.

Through D7 Visa, you can benefit from:

- Travelling around the Schengen Area visa-free.

- Getting residence permit for a year, with a renewal option leading to permanent residency after five years.

- Having access to health and education services.

- Including your family members as long as they meet certain criteria.

- Having a fast processing time

If you’re planning to apply for a D7 Visa, you’ll be required to submit documents that show your passive income.

D8 Visa

Suitable for freelancers, remote workers, and entrepreneurs; D8 Visa or Portugal’s Digital Nomad Visa offers the chance to live and work in Portugal for a maximum of one year. This visa requires a monthly income of €3,280 and savings of €36,480. It allows the holder to apply for temporary residency and, after five years, for permanent residency.

Key advantages of this visa type include:

- You can live in Portugal for at least one year.

- You can visit other Schengen countries for 90 days in every six months.

- After five years, you can apply for Portuguese citizenship as long as you meet the criteria.

- You can use Portugal’s public healthcare.

- There are good schools and universities. It is a good choice for families with children.

- The visa is not expensive. You just need to show you work online and have enough money.

- You may pay 0% tax on foreign income and 20% tax on income earned in Portugal. Note that you may potentially benefit from the New NHR tax regime, provided you meet specific criteria.

- Portugal has nice weather, fun culture, and cheaper living than other Western European countries. People care about work-life balance.

- Many Portuguese people speak English, especially in big cities.

D2 Visa

The D2 Visa is a residence visa for Portugal as an alternative to Golden Visa. It is for people who want to start a business or work independently. You can apply if you want to work for yourself in Portugal or if a company in Portugal has hired you to provide a service.

In a nutshell:

- If you are not from the EU, EEA, or Switzerland, and you want to live in Portugal as a freelancer or business owner, you can apply for the D2 Visa.

- You must have a company in Portugal or plan to start one. You can also invest in a Portuguese company or open a branch of your own company.

- You should show you have some money in a Portuguese bank.

- You must write a plan for your business. It must be clear and show how your business will help Portugal.

- You must buy health insurance for yourself. You must also buy it for your family if they come with you. It should work in all of Europe.

- You must stay in Portugal for at least 4 months in the first year. After that, you must stay at least 6 months each year.

Portugal Visa Types Timeline Overview for Americans

| Portugal Visa Types Overview | |||

|---|---|---|---|

| Visa Type | Best For | Financial Requirements | Processing Time |

| D7 Visa | Retirees, passive income earners | €8,460/year (~$9,620) minimum | 2–4 months |

| Digital Nomad Visa | Remote workers | €2,800/month (~$3,180) minimum | 1–3 months |

| D2 Visa | Entrepreneurs, business owners | Business plan + sufficient funds | 3–6 months |

| Portugal Golden Visa | Investors | €200,000 for donation – €500,000 for fund investment | 8–12 months |

| Student Visa | International students | Tuition + €820/month (~$930) living funds | 1–3 months |

| Family Reunification Visa | Family members of residents | Proof of relationship + sufficient income/support from sponsor | 3–6 months |

The Visa Process: Requirements for US Citizens

As an American, you have a couple of options to acquire the necessary visa or residence permit to move to Portugal for the long term. Here are some of your options:

- Portugal Golden Visa

- D7 Visa

- Student Visa

- Tech Visa

- Startup Visa

- Portugal D2 Visa

The Portuguese immigration and border service, referred to as Agência para a Integração, Migrações e Asilo (AIMA) in Portugal, carries out the visa application process. The Portuguese government allows online applications via this platform. As of 2020, residence permits can be automatically renewed, which is very convenient.

Required Documents

The documents you need to get for the Portuguese visa are:

- A passport that will be valid for at least three months longer than the duration of your stay,

- Two photos of passport size,

- Visa application form,

- A valid travel insurance contract,

- Financial ability proving that you can fiscally support yourself during your stay,

- or a Portuguese citizen or resident can sign a term of responsibility on your behalf.

Additional documents are needed if you’re applying for an employment visa:

- Proof that you’re qualified for the job,

- A work contract (or promise of work) signed by an employer, or a manifestation of interest,

- A competent authority must declare that you have the qualifications to work in your sector.

AIMA will require these documents to be no le

Becoming a Permanent Resident or a Citizen in Portugal

After getting your temporary residence in Portugal and renewing it within a duration of five years, you can apply for permanent residence or Portuguese citizenship.

The Portuguese permanent residence will cost $240 and AIMA will require the following documents:

- A valid passport

- A standard application form

- 2 recent colored identical photographs on a blank background

- Valid temporary residence

- Evidence of having sufficient means of subsistence

- Evidence of proper accommodation

- Permission from AIMA to have your criminal record checked in Portugal

- Confirmation of a basic grasp of the Portuguese language. For this document, there are various alternatives:

- A certificate from an officially recognized teaching establishment

- Completing language studies issued by a teaching establishment

- Completing elementary Portuguese studies issued by the Institute for Employment and Professional Training(IEFP)

- A Certificate of education of essential Portuguese such as Teaching Portuguese as a Foreign Language, recognized by the Ministry of Education and Science

Rights and Responsibilities of US Residents in Portugal

Once you become a legal resident in Portugal via one of the abovementioned residency visa types, you will have some rights and be considered responsible for certain things.

As a legal resident, you can:

- Work for an employer or be self-employed.

- Study and get professional training.

- Access public healthcare and legal help.

- Live with your family in Portugal (family reunification).

- Get fair treatment when it comes to social security, taxes, and public services.

- Have your US diplomas and qualifications recognized.

- Join labor unions and enjoy fiscal benefits.

You must also follow certain rules:

- Report any changes (like a new address or marital status) to the authorities within 60 days.

- Notify immigration services if you plan to leave Portugal for more than 6 consecutive months (or 8 months total if non-consecutive) while your permit is still valid.

- If you have a long-term residence permit, you can’t stay outside the EU for more than 12 months in a row, or outside Portugal for more than 6 years, or you may lose your permit.

- Students must tell immigration officials if they start a paid job and show their work contract. They must also register for taxes and social security.

Temporary residence permit holders must renew their permit within 30 days before it expires.

Can American Expats in Portugal Obtain Portuguese Citizenship?

In short, yes! Both Portugal and the United States of America allow for dual citizenship. You can apply for Portuguese citizenship by heritage, marriage and naturalization.

European Citizenship Through Heritage

Any European Union citizen has the right to live and work in Portugal. So, research your heritage. In your genealogy, you may have some Europeans. If so, you can apply for citizenship in the corresponding country and get the chance to live anywhere across Europe.

Mind you, if you served in the US military, it may void your chances of taking citizenship in another country through heritage. Though even in that case, your spouse may be eligible and you use them to get a visa and relocate as a dependent.

Citizenship by Marriage

To be eligible for Portuguese citizenship by marriage, you must:

- Be married to a Portuguese citizen for at least 3 years

- Live in Portugal with your spouse during that time.

- show basic knowledge of Portuguese.

After meeting these requirements, you can apply for citizenship.

Citizenship by Naturalization

For citizenship by naturalization, you must live in Portugal for at least 5 years. Once you have completed these requirements, you can apply for citizenship. During this time, you must meet the A2 level Portuguese language requirement and have an understanding of Portugal’s culture and society.

You can also be eligible through programs like the Golden Visa, D2 Visa, D7 Visa, or a Digital Nomad Visa after five years.

Moving to Portugal From the USA: Top 6 Considerations

The Portuguese government welcomes expats from the US and the move is generally straightforward. Before getting into details on a visa, there are a few things you need to know about Portuguese law when it comes to foreigners entering the country.

1. Customs

Getting through customs in Portugal is easy if you follow a few simple rules. Before you move to Portugal, you need to go to your local Portuguese consulate, or diplomatic mission, and ask for a Certificado de Bagagem (Luggage Certificate). You can obtain this by giving a complete inventory of your possessions and household goods, which you’re planning to take with you to Portugal.

Remember that your items on your Certificado de Bagagem will arrive within 90 days of your arrival in the country.

2. Shipping and Flying Goods

Luckily, you’ll find that shipping your belongings to Portugal is easy. Because the country has a very advantageous geographical position, you have a wide variety of options, such as air freight and sea freight. Road freight is not an option from the US, but sea freight is an affordable alternative to air freight, although slightly slower.

Below is a table according to World Freight Rates and SeaRates, to give you the average cost of sea freight for a 20ft container of furniture when moving to Portugal.

| Departing | Destination | Price | Duration |

|---|---|---|---|

| New York City, USA | Lisbon, Portugal | $1,229.11 | 14 days |

| New York City, USA | Figueira Da Foz, Portugal | $1,297.98 | 14 days |

| Los Angeles, USA | Lisbon, Portugal | $2,993.41 | 27 days |

| Los Angeles, USA | Figueira Da Foz, Portugal | $3,161.21 | 28 days |

If you’re in a hurry, you can choose to ship your belongings by air freight. It typically takes about two-four business days with express shipping and five-eight days with standard shipping. Keep in mind that for large quantities, sea freight is easier.

In the table below, you’ll find the average prices for shipping a single m3 250KG container of household items. Landing anywhere in Portugal costs about the same as landing in Lisbon.

| Departing | Destination | Price |

|---|---|---|

| New York, USA | Lisbon, Portugal | $2,705.42 |

| Los Angeles, USA | Lisbon, Portugal | $3,205.42 |

3. Storage

Storage in Portugal requires some preparation in advance. A quick online visit to storage companies near where you’re planning to move will be enough. Most storage companies work 24 hours a day and are very helpful to expats. Keep in mind that exact pricing is hard to find online and you might need to do that via email or a phone call.

4. Moving to Portgual from US with Pets

Over 64 percent of all US households own pets. If you have pets, then rest assured that your four-legged family members are more than welcome in the eyes of Portuguese customs.

All you need for your pet is a rabies vaccination, which also means they must be older than three months. For some breeds that may be considered “dangerous”, you might need to sign a liability term and have a local vet examine them to get a special permit.

5. Vaccinations

There are no official Portuguese laws for vaccinations, though it’s always recommended to make an appointment with your local doctor before visiting anywhere new. Better safe than sorry.

6. Getting a Driver’s License

As a US citizen, you can use your driver’s license for up to six months in Portugal. Once this period expires, you need to change it to a Portuguese driver’s license. At this point, some states only want from you paperwork and translation, while others need a driving test.

American Expat Life in Portugal

Before moving, you must be wondering about what it is like to live in Portugal as an expat. Let’s have a glimpse of it now.

Blue Skies and Warm Smiles

The Portuguese are world-renowned for their hospitable attitude towards foreigners. According to Expat-Insider, 83 percent of expats find moving to Portugal and settling there to be very easy and straightforward, where the worldwide average is 59 percent. Besides, the Portuguese culture is so welcoming that 82 percent of expats living in Portugal say that they feel largely at home.

Family-Friendly Fun

If you’re a US citizen thinking about immigrating to Portugal with your family, you’re making the right choice. Portugal ranks ninth out of 50 destinations according to the family life index. The index takes into account the availability of child care and the level of education in the country.

Excellent Work-Life Balance

Portugal boasts a competitive economy thanks to its tourism and real estate sectors, which are amongst the strongest in Europe. Over 72 percent of expats rate the Work-Life balance to be very good.

Cost of Living Portugal vs. the US

One of Portugal’s most attractive qualities is its affordability. Lisbon wears a proud badge of being one of the cheapest European capitals in the world. The average monthly cost of living for a couple in Lisbon is about $2,500. In smaller cities, it’ll drop to $2,000 a month. At this point, we should also note that many American expats can easily afford the inflated prices that locals cannot.

The rent for a one-bedroom apartment will range between €700 and €1,800 per month in Lisbon, depending on the neighborhood. It’s also relatively affordable to purchase real estate in Portugal.

Compared to the US, it’s very cheap to eat and drink in Portugal. Beers are €3-4, wine €5, and most meals are €10-12.

Household goods are also cheaper in Portugal in comparison to the United States. Although Lisbon is the most expensive city in Portugal, compared to New York City, life is so much cheaper for local people.

Real Estate and Rent

Rents in Portugal offer more affordable costs. For example, in Lisbon, you can find a one/two-bedroom apartment for around $1,628.40 a month, while similar properties in the US will cost around 3,926.09. But that’s not all, remember that in a city like Porto or even smaller cities, you can find such property for the competitive price of $500 a month.

If you’re planning to relocate to Portugal for the long term or for retirement, then it’s a great value option for you to buy real estate. Portugal has minimal restrictions for foreigners buying properties, and the government encourages non-Portuguese residents to invest in real estate through programs like the Portuguese Golden Visa.

You can find more extensive information in our guide to Buying Property in Portugal.

Food and Drink

The food and drink scene lies at the heart of Portuguese culture. The country’s long coastline provides a rich seafood cuisine. There is also an abundance of cheeses and smoked meats. A regular grocery list should run you about $200 a month.

Keep in mind that many items Americans consider luxuries, such as almond milk, olive oil, and wine, are produced locally in Portugal. You can find a tasty local bottle of wine for about $5.77.

Portuguese Cities

Compared to US cities, all Portuguese cities are small. The biggest city in Portugal is the capital, Lisbon. It’s home to only about half a million people. But don’t for a second think that you’ll give up the bustling city lifestyle in Lisbon.

However, you might want to move away from the noise and enjoy an idyllic lifestyle somewhere along the coast of the Algarve. Wherever you decide to move, you’ll find that most cities in Portugal are quite affordable. Below is a table comparing various items and services between Lisbon, and New York According to Numbeo as of April 2025:

Healthcare in Portugal

Portugal’s healthcare system is not entirely free, but unlike in the US, you won’t fall into debt to pay your medical fees. The government funds healthcare generously; those under the age of 18 and over the age of 65 get completely free healthcare.

You can’t enjoy the benefits of public healthcare as a temporary resident, except for emergency cases of course. Until you obtain your permanent residence, you’ll need to sign up for private health insurance. Luckily, private health insurance is cheap and will cost you about $440 for a basic yearly plan and about $1,100 for more extensive coverage.

The Job Market in Portugal For Americans

The Portuguese job market is competitive and growing, much like the country itself. Portugal, and more specifically Lisbon, has become home to many tech companies and start-ups. So if you’re a professional in the IT sector or the online business field, Portugal will welcome you with arms wide open.

For more traditional sectors, you may need some knowledge of Portuguese. However, if you’re a polyglot, then you can most likely find an excellent job in the tourism sector.

All workers are required to contribute to social security, and that is taxed at 11 percent of their income, which in return offers the following benefits:

- Unemployment Benefits

- Maternity And Paternity Benefits

- Old Age Pension

- Disease and Sickness Benefits

- Death Benefits

- Invalidity Benefits

- Work Injuries and Other Health Conditions Benefits

The Most Common Jobs in Portugal

Portugal’s economy is ever-growing, which is why the job market is always looking for professionals to join from all around the world. However, keep in mind that average Portuguese salaries may not support rent in major cities.

Here’s a table of the most in-demand professionals and their monthly average salary.

| Average Annual Salaries by Job in Portugal | |

|---|---|

| Job | Yearly Average Salary |

| Accountant | €38,857 |

| Architect | €45,228 |

| Doctor, General Practice | €84,557 |

| Help Desk Technician | €28,532 |

| Hotel Manager | €74,577 |

| Marketing Manager | €35,688 |

| Nurse | €33,259 |

| Product Manager | €55,930 |

| Receptionist | €16,788 |

| Software Engineer | €43,700 |

| Teacher | €30,000 |

| UX Designer | €48,000 |

| Web Developer | €30,284 |

Minimum Wage and Average Salary

The average salary in Portugal falls between $1,200 and $2,000, depending on the qualifications and experience of the worker. The minimum wage is $752 a month, yet keep in mind that the minimum wage is not taxed. You only start paying taxes if you earn more than $780 a month.

Education

The education system in Portugal is both excellent and affordable. The country offers free education for its residents and citizens up to the age of 18. If you live in or around Lisbon, you can easily find an international school with a global, American, or British curriculum.

Some of the most popular ones are:

- TASIS Portugal

- United Lisbon International School

- International Preparatory School

- British School Lisbon

Annual private school fees in Portugal vary between $ 9,700 to $16,600, depending on the school and curriculum. Check out our comprehensive guide for more information on Portugal’s International Schools.

Climate in Portugal

The warm sun and cool ocean breezes are what you have to look for when moving to Portugal from USA. Portugal is probably on your list thanks to its Mediterranean weather.

There is rarely any snow in Portugal. Throughout the whole year, the weather is rather warm. Even the winter is usually more chilly than really cold. Of course, if you venture further north, you might find some slightly colder winters.

Portuguese Culture

Moving to Portugal from the US often stands out with its vibrant lifestyle. People love being together, creating a strong sense of community. They love spending time with their families and friends whether it is an ordinary meeting or a special occasion. Thus, we can say that they will welcome you friendly when you start to live in Portugal.

Along with this rich culture, English is widely spoken in Portugal. This allows you to integrate yourself into everyday life. Of course, learning a basic level of Portuguese will make things easier for you, especially if you prefer living in rural areas.

Internet and Telecommunications

The internet and telecommunication have become inseparable parts of our lives. It gains more importance if you are considering moving to another country while your whole life connections are in another.

In Portugal ANACOM regulates telecommunication service and aims to improve its digital services with improvements. Besides, Portugal ranks 26 in the worldwide internet speed test. Here are the some of the providers and their speed:

Internet Provider | Download (Mb/s) | Upload (Mb/s) |

Vodafone | 177,8 | 92,1 |

MEO | 139,0 | 84,2 |

NOS | 129,4 | 55,9 |

Learning Portuguese

Language is the key for human connection. Therefore, it matters a lot to survive in this world, especially when you are new in a country. Although there are many English speaking people in Portugal, learning Portuguese can put you in a more comfy place and even open the doors for citizenship after five year residency.

To do that, you can enroll in a Portuguese language course and learn the everyday language. Similarly, you can opt for using language learning apps or watch movies or tv shows. To engage with the locals or expats like you, you can even join speaking clubs.

Accommodation for Americans in Portugal: Rent or Buy?

You first need to decide whether you want to rent or buy a home when you move to Portugal. Each has pros and cons.

Renting in Portugal

Renting property in Portugal will give you flexibility and it’ll let you adjust to the country, the neighborhoods, and life in general. You can also rely on your landlord for maintenance fees, repairs, and upgrades. Unlike the United States, landlords are responsible for paying the maintenance and condo fees of their units, not the tenants.

However, you should also be aware that in major cities like Lisbon or Porto, it is getting hard to find a long-term rental property. Also, many people complain about poor insulation, humidity, noise, and minimal heating in rental properties. So, check it before making a final decision.

Additionally, you may encounter poor-quality housing in isolated areas and scammers who can request documents before arranging a viewing. So, make sure you have seen the house and work with a reliable real estate agent.

Buying Property in Portugal

Buying the property in Portugal can save and even earn you money in the long turn. However, you’ll be responsible to deal with all the maintenance issues, fees, and taxes related to the property.

Nevertheless, you’re allowed to take a mortgage with competitive terms when moving to Portugal.

6 Steps to Get a Mortgage in Portugal

There are two types of mortgages available in Portugal. The first one is fixed rate mortgages while the second is variable rate mortgages. Fixed rate mortgages are more stable and available for a certain period of time. On the other hand, based on EURIBOR’s interest rates, variable mortgages can change according to the market conditions.

- Step 1: To obtain a mortgage in Portugal as an American expat, you can start by talking to a broker or bank and filling forms online. They will assist you through the mortgage process, telling you the likelihood of getting a mortgage and under which circumstances.

- Step 2: After a quick careful review within two days, you will receive a quote.

- Step 3: Once you get the quote, carefully analyze the terms and conditions related to the mortgage. If it aligns with your interest and budget, you can sign a terms and conditions document.

- Step 4: You must pay the application fees. Then, they must assist you through the application process on behalf of you.

- Step 5: As soon as you get an approval, they will provide you with the terms and conditions.

- Step 6: On condition that you confirm, you must open a Portuguese bank account and pay the necessary fees such as deposits. Eventually, you will have a property in Portugal.

The Portuguese Tax Number

The tax number is known as the NIF or Número de Identificação Fiscal. Obtaining this number is essential and should be on the top of your checklist when moving to Portugal.

Applying for a tax number is relatively easy if you know the steps.

- You just need to go to the closest tax agency (Finanças).

There are two types of tax numbers, a non-resident and a resident one.

- If you’re applying for the former, you need proof of address of your last country of residence and a tax representative. This person has to be a Portuguese citizen, and they will be responsible for making sure that you pay your taxes.

- If you’re applying as a Portuguese resident, then you need your proof of address in Portugal. You will need to have an ID in both cases.

Opening a Bank Account in Portugal as a US Citizen

Opening a Portuguese bank account is generally quite easy while moving to Portugal. As one of the best countries Americans move to, you need to bring these documents:

- The Portuguese tax number, NIF

- A valid ID

- Proof of address

- Proof of employment

You then need to choose one of the banks that allow Americans to open a bank account in Portugal. Due to the high regulations enforced by the IRS in compliance with the Foreign Account Tax Compliance Act (FATCA), some banks will refrain from accepting US citizens as a client.

List of International Banks in Portugal

Most banks in the country are Portuguese. There are some International Banks, however, that have specific banking products for expats. Such as:

- ING Bank

- BNP Paribas

- Barclays

- Abanca

- Deutsche Bank

How Can Get Golden Visa Help You?

Get Golden Visa is a full-service investment and immigration agency. We have local offices in Lisbon and Porto, Portugal. We have legal professionals, as well as chartered real estate professionals within our team.

Contact us to get more information about moving to Portugal through investment.

Contact Form

Taxes for American Expats in Portugal

Essentially, you need to pay taxes on your American earnings in America and taxes on your Portuguese earnings in Portugal. American expat communities that live in Portugal are obliged to file tax returns in both countries. To do this, you must complete the forms below:

- The Form 1040: You must file your worldwide income regardless of where you live.

- The Form 1116: You must file it for the taxes you paid in Portugal to prevent the double taxation.

Nevertheless, there is a double taxation agreement between the US and Portugal. This is to prevent double taxation on the same income for American dual citizens or expats. Assume that you are living and making money in Portugal as an American expat. In the worst scenario, you will be double taxed on the same income you make in Portugal. However, thanks to this treaty, the taxation of your income will be based on the residence.

Americans Retiring in Portugal

There are a few things to consider if you are an American retiree in Portugal.

First, figure out what you want from your retirement. You could want to play golf on a regular basis or volunteer in your new neighborhood. You should consider starting a gardening project. Whatever your objectives are, it’s a good idea to consider them when deciding to retire in Portugal from the US.

Portugal offers different lifestyles with many alternatives. You may desire a vibrant expat community…You may prefer to take a step back and seek a more distant and serene location with long-term residents.

Here are some of the benefits of moving to Portugal for US citizens:

- Political Stability

- Healthcare

- Fresh Food

- Easy Immigration Criteria

- Tax Breaks

- Route to EU citizenship

- Tolerant Community

Pros and Cons of Living in Portugal as an Expat

Deciding on where to move requires an elaborate analysis of ups and downs of a specific country. The same thing applies to Americans moving to Portugal too. Let’s look at how:

Pros of Living in Portugal

- You can gain many benefits such as access to social security, healthcare, and education in European standards.

- You can travel freely around the Schengen area with a Portuguese passport.

- As a permanent resident, you can also apply for family reunification and bring your family to Portugal.

- There is a balance between work and life, offering flexibility for freelancers and digital nomads. For example, you can go to the beach within a short amount of time after work in Lisbon.

- You can adapt yourself to the country’s friendly atmosphere and enjoy the sense of Portuguese community easily.

- With a 1.372 Global Peace Index in 2024, Portugal stands out as one of the top 10 safest countries in the world.

- With its historical architecture and natural beauties, there are lots of things to discover in the city.

Cons of Living in Portugal

- You may experience culture shock and miss your family once you start to reside there.

- Even though many people know how to speak in English, you may need to learn Portuguese to join the everyday life, especially in rural areas.

- As one of the tourist centers, the city’s population can be overwhelming from season to season.

- Dealing with Portuguese bureaucracy can be frustrating as the processes can take longer than expected.

- Traveling to rural areas can be hard, especially if you do not have a car as there is a lack of transportation.

- Xenophobia is mild but present specifically towards newcomers.

- Rent and property prices have risen 60-100% in recent years.

- It can be hard to find accommodation, especially in Lisbon and Porto. Landlords often demand 2 months’ rent + 2 months’ deposit, and a “fiador” (a Portuguese guarantor who’s legally responsible if you can’t pay). Without a fiador, many landlords ask for 6-12 months of rent upfront.

- Apartments are often of poor quality, usually cold in winter, have no insulation, are noisy, and are not like the photos online.

- Local salaries are very low compared to other European countries. So, unless you work remotely or have savings, it is hard to live well on a local income.

Before making your move to Portugal from the US, you should first visit, learn even basic Portuguese, and explore smaller cities.

Where to Live in Portugal as an American: 6 Best Cities

1. Lisbon

Lisbon is a cosmopolitan city with a vibrant culture that is ideal to live and retire in Portugal from the US. The hustle of a huge metropolis combined with a lovely historic center and proximity to gorgeous beaches makes Portugal’s capital city a great choice for retirees seeking the best of both worlds. Many individuals in Lisbon know English which makes it a favorable city for American retirees.

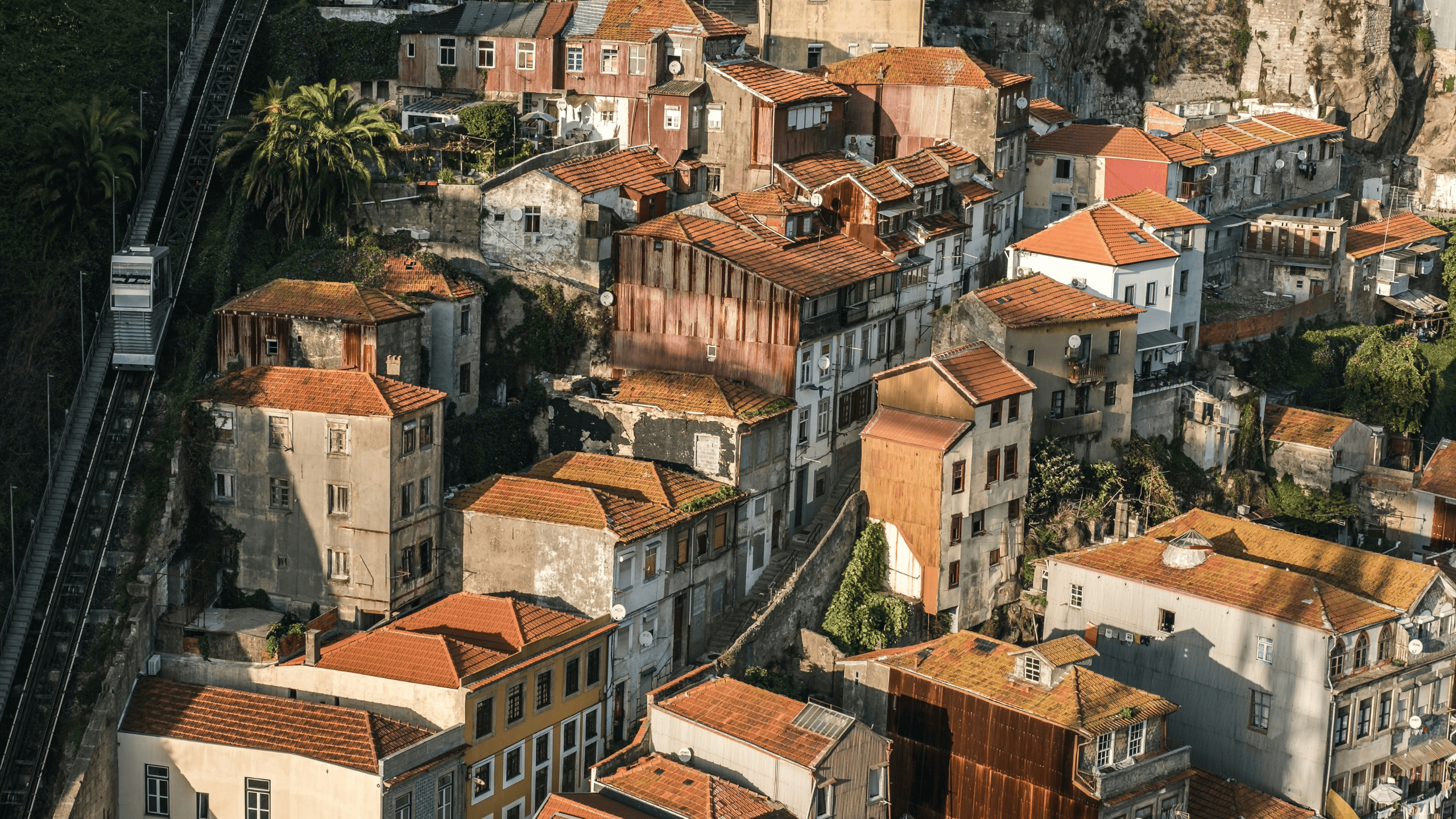

2. Porto

Porto, Portugal’s second city, is frequently disregarded by expats relocating to Portugal because of its northern position, but this magnificent city on the banks of the Douro should not be overlooked. Porto is a very safe city. It is also less expensive than Lisbon, making Portugal retirement for US citizens affordable.

3. Braga

Braga is one of Portugal’s oldest cities and a wonderful alternative to Porto and Lisbon for Americans retiring in Portugal from the USA. It is known for its vibrant nightlife as well as its rich history since the city is home to one of Portugal’s oldest cathedrals. It is in a great location, only 30 minutes from the beach, 15 minutes from the mountains, and 40 minutes from Spain.

4. Madeira

Madeira isn’t the first place that comes to mind when Americans dream of retiring in Portugal from the USA. Funchal, the island’s largest city, is on the rise and offers a magnificent location with mild weather all year. The island is not swamped with tourists and is less crowded than mainland Portugal.

5. Coimbra

Another Portuguese city for everyone thinking of moving to Portugal is Coimbra. Once was the capital of Portugal, it is a laid-back city with a low cost of living. It is home to Portugal’s oldest university, providing the city with a vibrant atmosphere.

Coimbra is a safe city with loads of interesting architecture and culture to see, making it a good location to retire in Portugal from the USAfrom USA. Also, it is a city that is well connected by train to other parts of the country.

6. Portimão

Sunny Portimao is a popular destination to retire to Portugal from the USAfrom USA, with a laid-back vibe and plenty of trendy beach cafés and spots to soak in the ambiance in the ancient town center.

It is crucial to remember that transportation in the Algarve is often poorer than in the rest of Portugal, and you may need to rent a car. Still, Portimao is well connected to other major locations such as Lagos and Faro.

Frequently Asked Questions on How To Move to Portugal

How much money do you need to immigrate to Portugal?

The government usually makes it easy for Americans to obtain residency. Usually, you’ll start by getting a visa for residence purposes which is valid for 120 days. For that visa, you need paperwork proving that you have at least $1,070 per month.

Can Americans apply for Portugal Golden Visa?

Americans can and do apply for Portugal’s Golden Visa. The Golden Visa program is a residency by investment program available for any non-EU citizen. A growing number of US citizens find Portugal to be an interesting country to invest in and obtain a residency or second citizenship in. Check out our guide on Portugal Golden Visa for Americans.

Is healthcare in Portugal free?

Public healthcare is free for those under the age of 18 and over the age of 65. For other ages, it’s not entirely free, but it’s relatively cheap.

Is an American driver’s license valid in Portugal?

Yes, you can use a car in Portugal with your American driver’s license.

Is Portugal a safe country?

Yes, it is. Portugal remains one of the safest countries in the world. It is always in the Top 10 list of Annual Global Peace Index released by the Institute for Economics and Peace.

Is it safe to drive in Portugal?

Commonly it’s safe to drive anywhere in Europe. Portugal nationals do have a reputation for going slightly faster than other countries. The road system has seen a drastic improvement in recent years, especially with some incredibly safe motorways. Lisbon is the only city with relatively dense traffic, while most other cities in the country offer a smooth ride.

How long can a US citizen live in Portugal?

US citizens may enter Portugal for up to 90 days for business or for tourism without the need for a Portuguese visa. If you would like to move to Portugal and spend more than three months there, then you’ll need to get an appropriate visa or a residence permit.

How many American expats live in Portugal?

Data shows that the number of registered American expats in Portugal is roughly 6,600. It looks like the number will be growing in the coming years with more and more people looking for a way to work remotely.

Can I retire to Portugal from the USA?

Yes, you can. Data show that many senior people choose to retire in Portugal. The Mediterranean country experience has much to offer to retirees. For more information, check out our extensive article on Retiring in Portugal.

Do American expats need insurance in Portugal?

If you will stay in the country less than 185 days, you can use. However, you must get a Portuguese or EU driving licence.

What is the average salary in Portugal?

The average monthly salary in Portugal is €1,065.07.

Do you have to pay taxes in the US even if you live in another country?

Yes, you need to pay taxes in the US as a tax resident. However, the US and Portugal have tax treaties that prevent double taxation.

Is it possible to move to Portugal without a job?

Yes, it is possible to move by having a residence permit through options such as D7 and Golden Visa. For a Golden Visa, you need to make a qualifying investment while D7 requires passive income.

Do you have to pay social security taxes in Portugal?

If you are an employee or self-employed in Portugal, you must pay social security taxes. Note that, if you work as an employee in Portugal, the tax amount will be automatically deducted for your salary.