Private equity funds provide individual or institutional investors with unique investment alternatives. Anyone interested in investing in a private equity fund, however, should first learn about the fund’s structure so that they are aware of the amount of time and money they will be required to contribute, as well as the related management and performance fees and responsibilities.

In this article, we’re going to give you an introduction to private equity funds in Portugal.

Contact us and talk to one of our experienced experts to help you with your questions.

What Is a Private Equity Fund?

Private equity funds are closed-end funds. Their capital is not listed on a public exchange because they are private. High-net-worth individuals and a variety of institutions can invest directly in and obtain equity ownership in firms through these funds.

Once the fund reaches a certain level of commitment, it is typically closed to additional investments.

Key Takeaways

- Private equity funds are non-public, closed-end funds that are not traded on stock exchanges

- Both management and performance fees are included in their fees

- General partners and limited partners are two types of private equity fund partners

- The limited partnership agreement specifies the amount of risk each party assumes as well as the fund’s lifespan

- Limited partners are responsible for the entire amount they invest

- General partners are completely liable to the market

Portugal Private Equity Funds

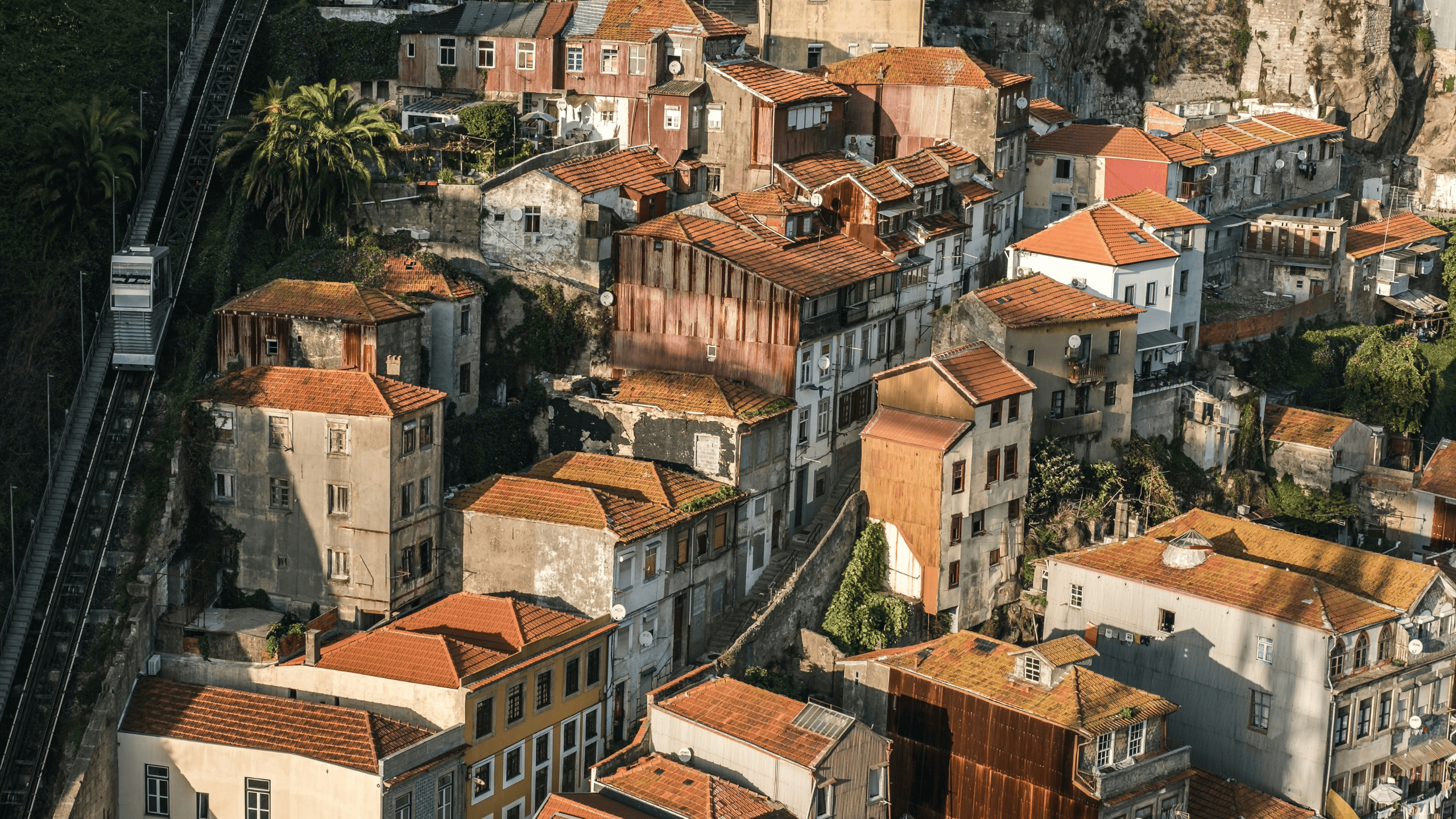

Private equity (PE) funds managed by Portuguese-based management firms dominate the Portuguese private equity sector. However, the rise of real estate (particularly in Lisbon and Porto) as well as the tourism boom, among other factors, have been drawing the attention of yield-seeking international PE fund managers to Portuguese assets.

Also, the government changed the criteria for granting “Golden Visas” visas in 2018, lowering the amount of investment to €350,000 in investment funds as opposed to the previous requirement of €500,000. This attracted new types of investors and prompted fund structuring innovation.

Note: The investment has been reincreased to €500,000 on January 1st, 2022.

Fundraising

After a couple of slow years, fundraising for private equity funds in Portugal has started to revive. The following factors could have an impact on the fundraising rebound:

- The Portugal Golden Visa program

- Increase in the Portuguese tourism sector

- The overall growth of Portugal’s economy

Funding Sources

Private equity funds typically obtain their funding through banks. Retail investors from outside the European Union (EU) and European Economic Area (EEA) who subscribe to the funds for a Golden Visa in Portugal are another group of major funding sources.

Taxes

Private equity funds are exempt from taxes.

The tax framework regime for PE fund participants varies depending on whether they are tax resident individuals or entities, non-resident individuals, or non-resident entities.

Tax Residents Individuals That Invest in PE Funds

This group of investors usually aren’t liable to pay the following:

- 10 percent final withholding tax rate on income

- 10 percent tax rate on capital gains

Non-Resident Individuals That Invest in PE Funds

These investors benefit from the following:

- Tax exemption on income

- Tax exemption on capital gains

Fund Duration

Although it varies broadly from fund to fund, the typical fund duration is10 years. It is also common to extend the initial duration of PE funds by one to two years. Typically, the investment period is about half of the fund’s initial duration (five years).

Investment Objectives

Private equity funds usually aim to invest in the following:

- Growth transactions in small and medium-sized businesses with the goal of internationalization or scaling up

- Funding for start-ups at the seed, start-up, and other stages

- Investment in real estate properties through the use of SPVs

Licenses

Under Portuguese law, private equity fund managers must obtain permission from the securities market regulator (CMVM) before they can operate.

PE fund management can be carried out by the following:

- Private equity companies

- PE fund management firms that are AIFM Directive compliant

- Regional development companies

Investors do not need any special authorization or license to subscribe to units in a PE fund.

Regulation

PE funds and companies are subject to regulation under Portuguese law. They’re also supervised by the Portuguese Securities Market Commission, called CMVM. However, this regulation is less strict than that of other fund management firms.

PE vehicles also are subject to the Portuguese Securities Code’s general limits on the marketing and advertisement of securities.

Differences Between Private Equity and Venture Capital

Private equity and venture capital (VC) invest in companies of various sizes and sorts, commit varying amounts of capital, and claim varying percentages of ownership in the companies in which they invest.

Funds dedicated to VC investment are often smaller, and state-owned/public investors are more prominent. VC investments are typically made with equity and quasi-equity convertible instruments, rather than debt, which is more frequent in buyout and growth investments of start-up companies.

Portugal Golden Visa Investment Funds

Private equity funds and venture capital funds are quickly becoming one of the most popular ways for persons seeking a Portugal Golden Visa. A minimum investment of €500,000 qualifies investors for a Golden Visa.

Benefits of Investment Funds

Higher Potential Yield

Capital gains yields can be much greater than other investment options that qualify under the Golden Visa program, depending on your investment profile and the policy and targeted risk/return of the fund you choose.

Lower Costs Than Real Estate Acquisition

Buying real estate assets entails paying a tax of roughly seven percent on the transaction amount. Also, fund investment doesn’t require you to hire a property management company to manage your property.

Funds Are Strictly Regulated

The Portuguese Securities Market Commission regulates and supervises funds that are eligible for the Golden Visa scheme.

Working With Experts

Each fund has a distinct profile tailored to the needs of different clients with varying objectives and risk tolerances. Fund managers are professionals whose full-time duty is to ensure that the funds perform well.

Any investment, including one in Portuguese Golden Visa funds, carries some level of risk. You can analyze the risk on your own, but getting help from professionals is a good idea, especially if you don’t speak Portuguese or aren’t familiar with the Portuguese bureaucracy.